Life insurance

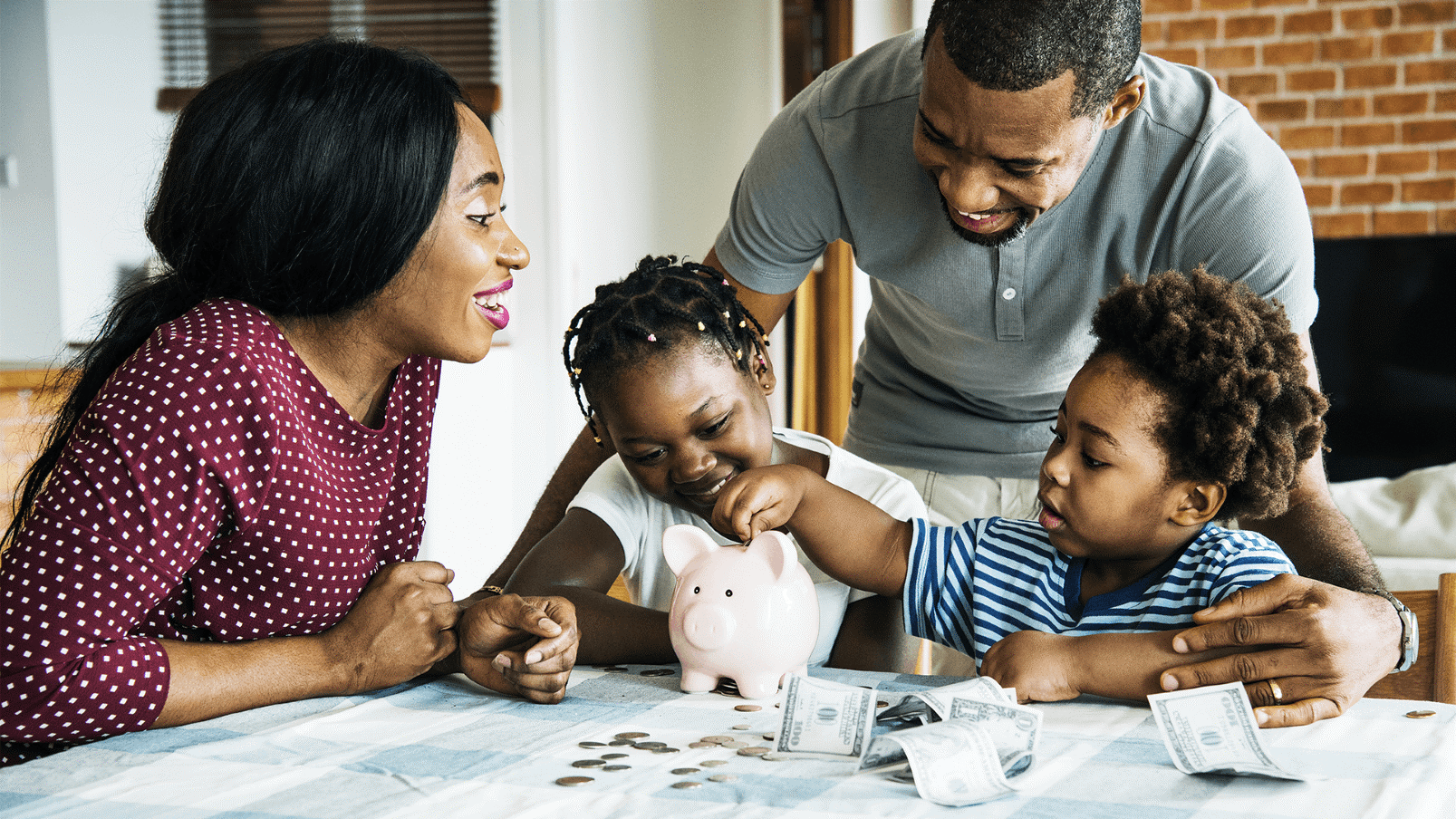

offers many benefits, including providing income-tax free, cash benefit payments to the named beneficiaries after the death of the insured person. Those death benefit proceeds can be used for any reason, including helping pay final expenses, paying valid debts, helping fund children's education, and providing loved ones with a financial safety net during a difficult time in their lives. Life insurance can also be used to help fund

retirement savings

, providing the potential for growth coupled with a level of security that can be difficult to find using traditional retirement savings vehicles.

So, why doesn't everyone have life insurance? In this blog post, we'll explore five common reasons people don't buy life insurance, and we'll discuss how to overcome those objections or perceived barriers.

1. People Assume They Can't Afford Life Insurance

First, many people simply assume they will not be able to afford life insurance, so they never apply for coverage.

Life Happens and LIMRA's seventh annual insurance study

found there is a tendency to overestimate how much insurance costs. When asked to estimate what a healthy 30-year old would pay for life insurance protection, the median guess was more than three times higher than the correct answer.

Whether you need the long-term protection whole life or universal life policies offer or just need coverage for a shorter term, life insurance can be affordable and coverage can be designed to fit your budget.

2. Death is an Unpleasant Topic

Another roadblock to buying life insurance is that it's not a fun subject. For some people, talking about death and life insurance needs ranks right up there with getting a root canal or being audited by the IRS. However, the reality is that nobody lives forever.

Planning for your loved ones by purchasing life insurance to help them manage financially if you die prematurely is a meaningful gift, although it is one that you won't get to directly benefit from.

3. More Affordable Coverage is Available through an Employer-Sponsored Plan

If you are lucky enough to work for an employer that offers group life insurance coverage, you may be able to take advantage of subsidized premium payments and lower group rates than what you could find on your own. However, don't make the mistake of thinking you don't need any individual coverage.

One problem with an employer-sponsored policy is that it may not be "portable", so if you leave your employer you won't be able to take the policy with you. Unfortunately, if you've relied on your group life insurance to meet your coverage needs but your health status has declined, you may find it difficult to find affordable individual coverage later.

4. Assuming There is No Need for Coverage While Young and Healthy

Another reason people don't buy life insurance is because they don't perceive the need for it when they are young and healthy. The reality, of course, is that anyone can develop a chronic or life-threatening illness at any time, or can be the victim of an accident or other unforeseen death.

The best time to buy life insurance is actually when you are young and healthy. Premiums are based on your attained age and health when you apply for coverage, so it is likely that you will never be able to buy the same coverage as inexpensively in the future as you can right now.

5. Confusion about What's Involved in Obtaining Coverage

For some people, the thought of buying life insurance is overwhelming and intimidating because they don't feel they understand how life insurance works. There is no question that life insurance can be confusing; there are several different types of policies with differing options and benefits, and the industry tends to be full of confusing acronyms.

When you choose to work with a dedicated insurance professional like the independent insurance agents at Symmetry Financial Group, you can be confident your agent will help you understand various policies and select coverage truly designed to meet your needs.

Learn How Easy It Can Be to Protect Your Loved Ones with Life Insurance

If you have been putting off purchasing life insurance because of one of the reasons listed above (or for any other reason), don't wait any longer. You owe it to yourself - and to your loved ones - to make protecting their financial future a priority.

To learn more about life insurance and the other insurance products offered by Symmetry Financial Group, call us today at (877) 285-5402, or

contact us online

.